- Patient access, investor opportunities & dispensary network expansion plans

Greece’s Medical Cannabis Rollout and Market Growth

Contents

Contents

Introduction to Greece’s Medical Cannabis Landscape

Greece has made significant progress in legalizing and implementing medical cannabis, marking an important step in healthcare. The first legalization took place in 2018, but in 2024, the rollout of THC-based medical cannabis products made them much more accessible to patients. Before this, despite legalization, patients couldn’t easily access the products they needed.

The Greek government aims to grow cannabis locally to ensure a steady supply, make it more affordable, and support economic growth. It is estimated that 50,000 patients could benefit from medical cannabis, with the market potentially reaching €2 billion by 2028. Greece’s efforts align with a broader trend across Europe, where many countries are revising their laws to include medical and recreational cannabis.

By learning from other European countries that have already implemented medical cannabis programs, Greece hopes to use best practices to make its program effective and affordable. Challenges remain, including changing public perception and improving regulations. However, the rollout is expected to significantly benefit patients, healthcare professionals, and the Greek economy, positioning Greece as an emerging player in the European medical cannabis market.

In the following sections, we will explore the timeline of Greece’s cannabis legislation, the details of the 2024 THC rollout, and comparisons with other European countries.

Timeline of Greece’s Cannabis Legislation

Greece began its journey toward legal cannabis in July 2017, when the government allowed medical cannabis for certain health conditions. In March 2018, Greece officially lifted the ban on cannabis cultivation for medical purposes, positioning itself as a future leader in the European market. By November 2020, the first licenses for growing and producing medical cannabis were issued. Finally, in 2024, the rollout of THC-based products made cannabis available to patients and aimed to boost the economy.

Timeline of Greece’s Cannabis Legislation

Details of the 2024 THC Roll-Out

The 2024 rollout of THC-based medical cannabis products in Greece was a major step in providing patients with access to new treatments. Before February 2024, even though medical cannabis was legal, no products were available for doctors to prescribe. Now, Greece has started providing these treatments, but they are only available from domestic production, resulting in limited options and high costs.

Currently, only dried cannabis flower is available, specifically the Midnight strain from Tikun Olam Europe. Four more flower products are expected to be launched later in 2024, and cannabis extracts should become available soon.

Growing cannabis locally is important as it reduces reliance on imports and helps stabilize prices. The government is working to simplify licensing and distribution to prevent shortages. Local production is expected to support the economy, create jobs, and reduce costs for patients, making medical cannabis more accessible to those in need.

Comparative Overview: Greece vs. Other European Countries

Greece’s rollout of THC-based medical cannabis in 2024 demonstrates progress but also highlights areas where it lags behind other European countries. Greece has allowed patients access to dried flower products, and more strains are expected soon. However, only one strain (Midnight by Tikun Olam Europe) is currently available, while other countries offer more variety.

Patients in Greece must pay for their treatment, as there is no reimbursement available. The cost is currently €82.96 for 5 grams or €165.91 for 10 grams, which amounts to over €16.50 per gram—significantly higher than in other European countries. For example, in the Netherlands, cannabis flower costs €6.50 per gram. Eligible conditions include chemotherapy side effects, chronic pain, multiple sclerosis, and appetite issues in palliative care. Initial prescriptions must be provided by specialist doctors, and follow-ups require another doctor every six months.

Germany

Germany leads Europe with an established medical cannabis system and many available products. Prices range between €10 and €15 per gram, and public health insurance helps cover the costs.

France

France is still testing medical cannabis, with an experimental program involving 3,000 patients. It expects to expand in 2024-2025, but there is no reimbursement available yet, making access harder compared to other countries.

Italy

Italy has a strict medical cannabis program, with costs ranging from €9 to €12 per gram. Public reimbursement is available in some cases, like chronic pain, which makes treatment more affordable.

Spain

Spain has not fully implemented its medical cannabis program. Recent regulations propose only allowing cannabis through hospital pharmacies, making it difficult for some patients to access. There is no public reimbursement for medical cannabis, which further limits accessibility.

Greece’s Unique Aspects

Greece’s strength lies in its focus on local production, which can help stabilize prices and reduce the need for imports. Greece is also working to build a complete supply chain, from growing the plants to delivering them to patients, to lower costs and increase efficiency. The government wants Greece to become a hub for cannabis research, which could attract international investment. However, balancing affordability for patients and growing the market is still challenging without public reimbursement.

Impact on Patients and Healthcare in Greece

The 2024 rollout of THC-based medical cannabis is set to significantly impact Greek patients and healthcare. For many, medical cannabis offers hope for managing chronic conditions such as pain, spasticity, and chemotherapy side effects, potentially improving their quality of life. Although patients have found cannabis effective, the high cost remains a significant barrier since there is no public reimbursement.

Healthcare professionals are also adapting. Only specialist doctors, like neurologists and anesthetists, can write initial prescriptions. Other doctors can provide follow-ups, but only after re-evaluations. Training programs are being developed to help healthcare workers effectively manage cannabis treatments.

Expanding access to cannabis could eventually reduce the overall costs of treating chronic conditions. More training is also needed to ensure medical cannabis is used correctly and that patients receive appropriate care. The government is exploring ways to make medical cannabis more affordable and increase product offerings, such as oils and extracts.

Regulatory Challenges and Market Outlook

Greece’s medical cannabis rollout faces several challenges that could slow progress. Complicated licensing requirements, bureaucratic delays, and the lack of public reimbursement make it difficult for companies to enter the market and for patients to afford treatment. Many businesses have reported delays in obtaining licenses, which has slowed down product availability.

Public perception is another issue. Many people still think of cannabis primarily as a recreational drug. Changing this perception will require public awareness campaigns and education on the medical benefits of cannabis.

Despite these challenges, the future of Greece’s medical cannabis market looks promising. The government is working to simplify the licensing process, and partnerships with international companies will bring in more investment and expertise. If these issues can be resolved, Greece could become an important player in the European medical cannabis market, with an estimated market value of €2 billion by 2028.

Benefits of Medical Cannabis THC Roll-Out for Greece

The 2024 rollout of medical cannabis in Greece provides numerous benefits. It offers patients new treatment options for chronic conditions like pain, multiple sclerosis, and chemotherapy side effects, especially for those who have not responded to other treatments.

Local cultivation creates jobs and supports economic growth, potentially making Greece a leading player in the European cannabis market. A vertically integrated supply chain helps keep costs down and ensures a stable supply.

The rollout is also attracting international partnerships and investments, which could boost research opportunities. Greece’s long-term goal is to lead in cannabis research and expand production to establish its role in the European market.

Global Context of Medical Cannabis Legalization

The movement toward medical cannabis legalization is growing worldwide, with countries like Canada, Germany, and Israel leading the way. By 2025, the global medical cannabis market could reach $44.4 billion, with over 40 countries allowing medical use. Regulations vary from strict to more open access models. The United States has also been expanding its medical cannabis legalization at the state level, which influences global trends.

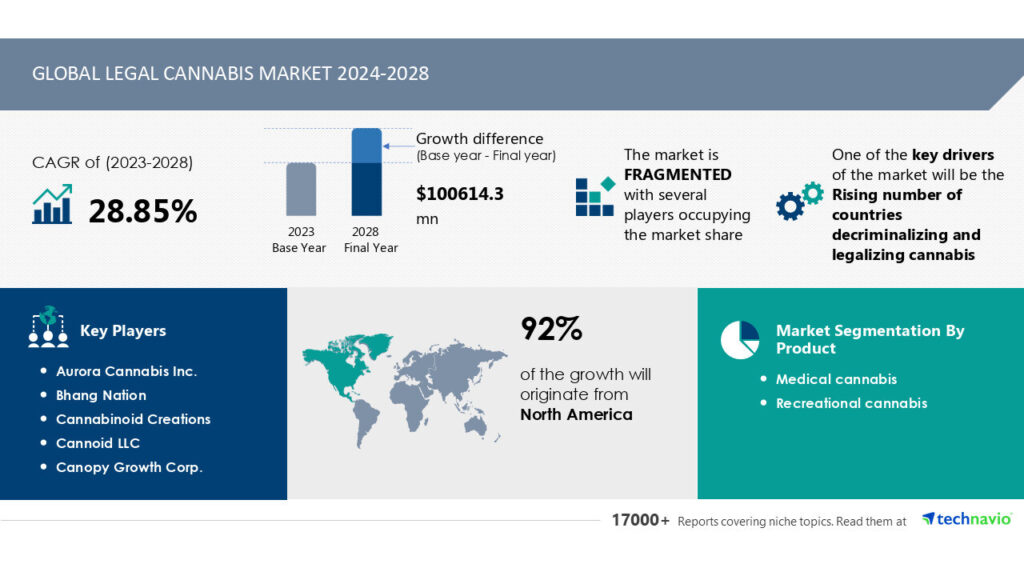

Supporting this trend, the global legal cannabis market size is estimated to grow by USD 100.61 billion, at a CAGR of 28.85% between 2023 and 2028. The market’s growth rate hinges on several key factors, including rising demand for cannabis-based products and expanding legalization efforts worldwide.

As an example of this growing trend, Poland is set to significantly increase its import cap on medical cannabis due to rising demand. The estimated annual demand for medical cannabis in 2024 has nearly doubled, increasing the total import limit from 6 tonnes to just over 11 tonnes. Medical cannabis businesses have already moved quickly to secure increased import permits to fulfill this demand.

However, challenges like public perception and inconsistent regulations still exist. Despite these obstacles, the trend toward acceptance is likely to continue, supporting economic growth and expanding treatment options for patients globally.

Greece’s Market Growth Potential in the European Landscape

Greece has significant growth potential in the European medical cannabis market due to its focus on local cultivation, vertically integrated supply chains, and investment in research and development. These strengths could make Greece a leader in medical cannabis production and exports. The government is also working to simplify the licensing process and create international partnerships.

Compared to more established markets like Germany, Greece still faces challenges, such as high costs and public perception. Government projects like the Cannabis Innovation Hub aim to boost research and expand production. With a projected market value of €2 billion by 2028, Greece could play a major role in the growing European cannabis market.

FAQs on Greece Medical Cannabis THC Roll Out

1. What is the current status of medical cannabis in Greece?

Medical cannabis has been legal in Greece since 2018, and THC-based products became available in 2024.

2. Who can get medical cannabis in Greece?

Patients with conditions like chronic pain, chemotherapy side effects, multiple sclerosis, and spasticity are eligible for medical cannabis. Specialist doctors determine eligibility.

3. How can patients get medical cannabis?

Patients need a prescription from a specialist doctor to get medical cannabis. Follow-up prescriptions can be written by other doctors after re-evaluation.

4. Is medical cannabis covered by health insurance?

No, medical cannabis is not covered by public health insurance in Greece. Patients must pay the full cost.

5. What products are available?

Currently, only dried flower products are available, specifically the Midnight strain from Tikun Olam Europe. Extracts and other products are expected later in 2024.

6. How much does medical cannabis cost?

In Greece, medical cannabis costs around €16.50 per gram, which is more expensive compared to some other European countries.

7. What are the benefits of local cannabis cultivation?

Local cultivation helps create jobs, stabilize supply, lower costs, and boost economic growth, making Greece an important player in the European market.

8. What challenges does Greece face in expanding its cannabis market?

Greece faces challenges like high costs, no insurance coverage, strict regulations, and negative public perception of cannabis use.

9. What is Greece’s long-term plan for medical cannabis?

Greece aims to become a leading producer and exporter in Europe, focusing on research and development, a complete supply chain, and more product offerings. The government also wants to make medical cannabis more affordable and available.

10. How does Greece compare to other European countries?

Greece is still developing its program and currently has fewer options and higher costs than countries like Germany and the Netherlands. However, its focus on local cultivation is a strong advantage.

Conclusion

Greece’s medical cannabis rollout is a significant step toward helping patients, boosting the economy, and making Greece a leader in Europe. Continued efforts to make medical cannabis more affordable and accessible are essential to further improving healthcare and expanding Greece’s role in the European market.

Disclaimer

The information provided in this article is intended for informational purposes only and should not be considered medical or legal advice. Always consult with a qualified healthcare professional before starting any new treatment.

Subscribe

Stay updated with the latest developments in Greece’s medical cannabis landscape. Subscribe to our newsletter for news, insights, and expert opinions on the evolving European cannabis market.